How Much Can You Claim On Tax Without Receipts

Yes you may still qualify for the charitable donations tax deduction without the charitable donation receipt.

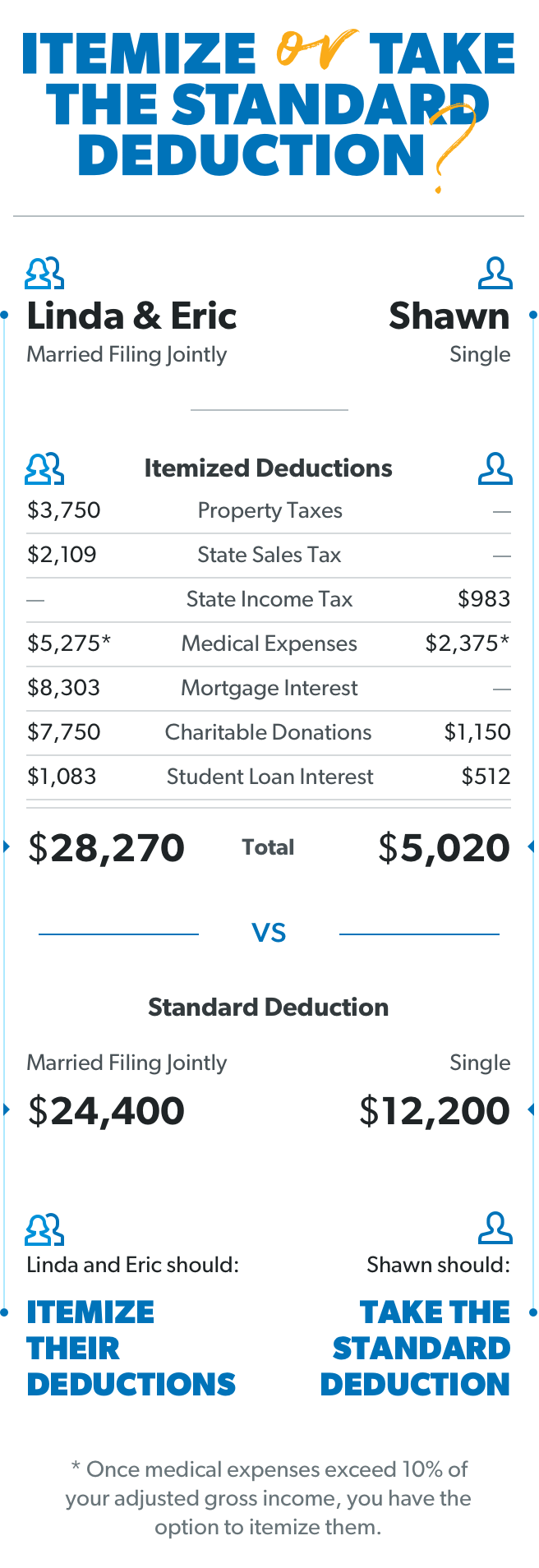

How much can you claim on tax without receipts. You are required to provide written evidence to claim a tax deduction if your total expense claims exceed 300. Sole traders and partnerships who work at home between 51 and 100 hours per month can claim 18 a month and those who work over 100 hours can claim 26. Deductions you cant actually claim on tax but swore you could. Understanding what you can and cannot claim without a receipt is useful when it comes to meeting your tax obligations.

If your total expense claims total less than 300 the provision of receipts is not required at all. How much cash donation can you claim without proof of receipt. However you can only include cash donations not property donations of less than 250. You are required to provide written evidence to claim a tax deduction if your total expense claims exceed 300.

You can claim work expenses up to 300 without receipts in total not each item with basic substantiation. The rules for charitable donations have changed in recent years. Heres a quick run down of what you can claim on tax without receipts in 2017. If you work at home between 25 and 50 hours a month you can claim a flat rate of 10 per month.

You dont need receipts for claims up to 300 but. People can claim work related deductions totalling up to 300 without receipts but assistant commissioner kath anderson said some taxpayers incorrectly believed they could make this standard 300. Simply snap store and organise your receipts on your phone so everythings in one place come tax time. At our temple we donate and no paper or receipts are given.

You can also claim 1 per load for washing or dry cleaning work uniforms and 50 for. However if you claim over 300 you need proper substantiation for all of the amount including the first 300. Maintain all records and receipts for 5 years from the date you lodge your return. For example the quickbooks mobile app features automatic receipt capture so you can keep a paper trail without the paper.

That you can make a standard claim of 300 without having spent the money.

/keeping-an-eye-on-the-figures-187147709-5a7df1983de4230037c5a100.jpg)

/135309863-56a938963df78cf772a4e4a9.jpg)

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)