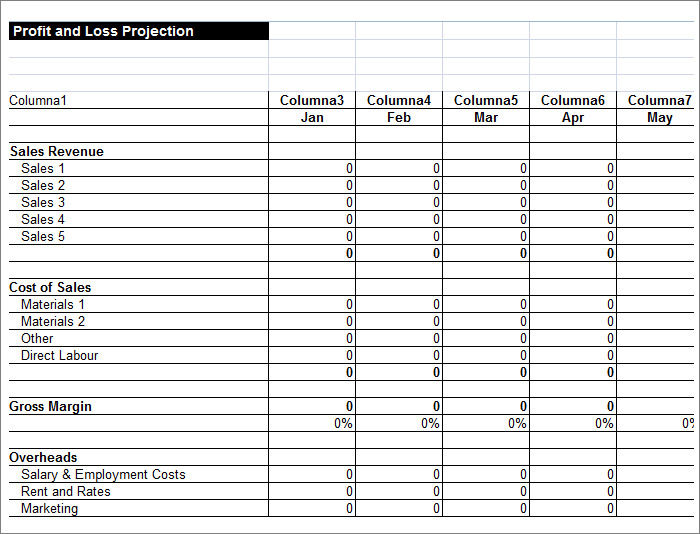

How To Make A Profit And Loss Statement Template

Your biz itemized revenue.

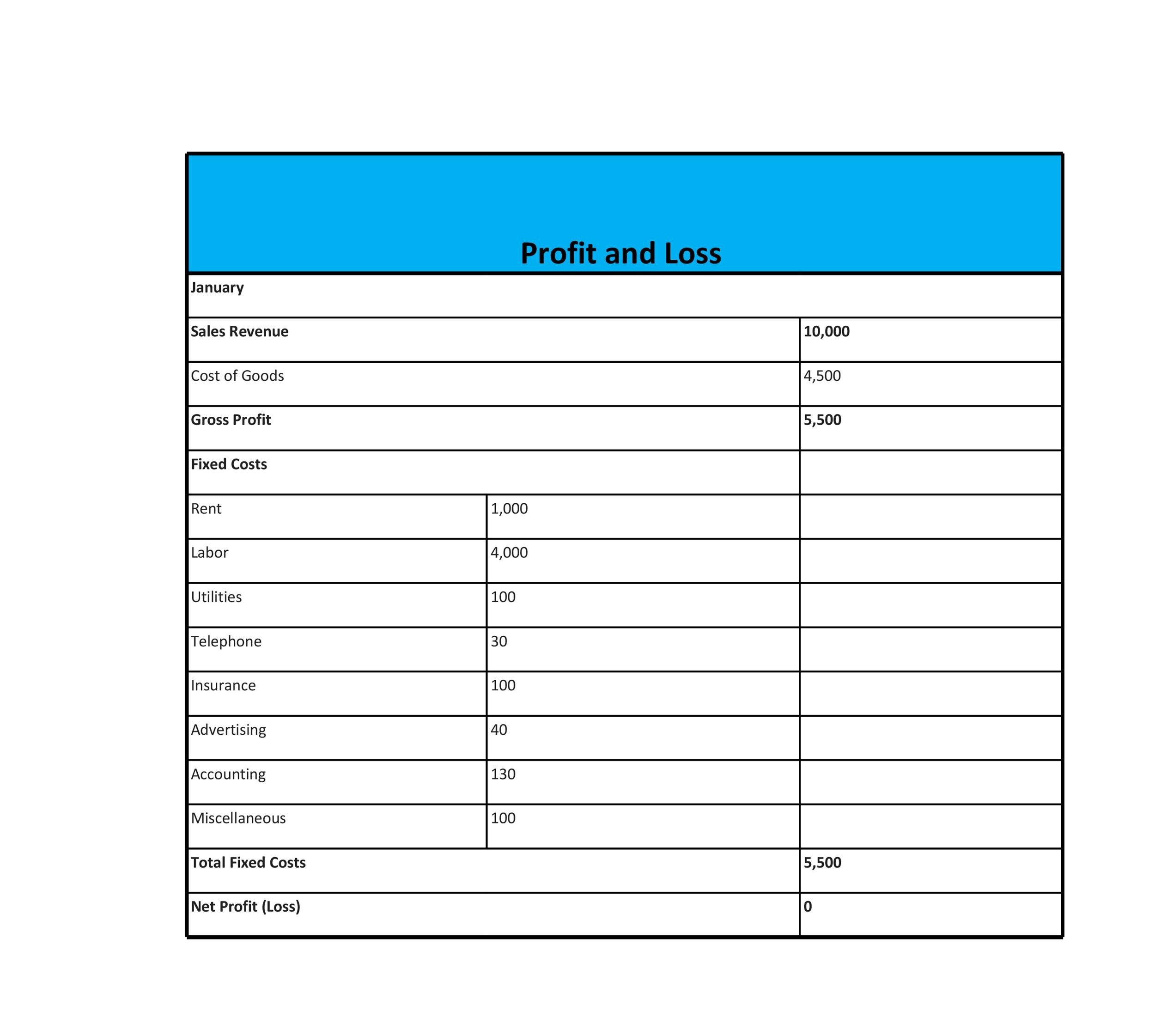

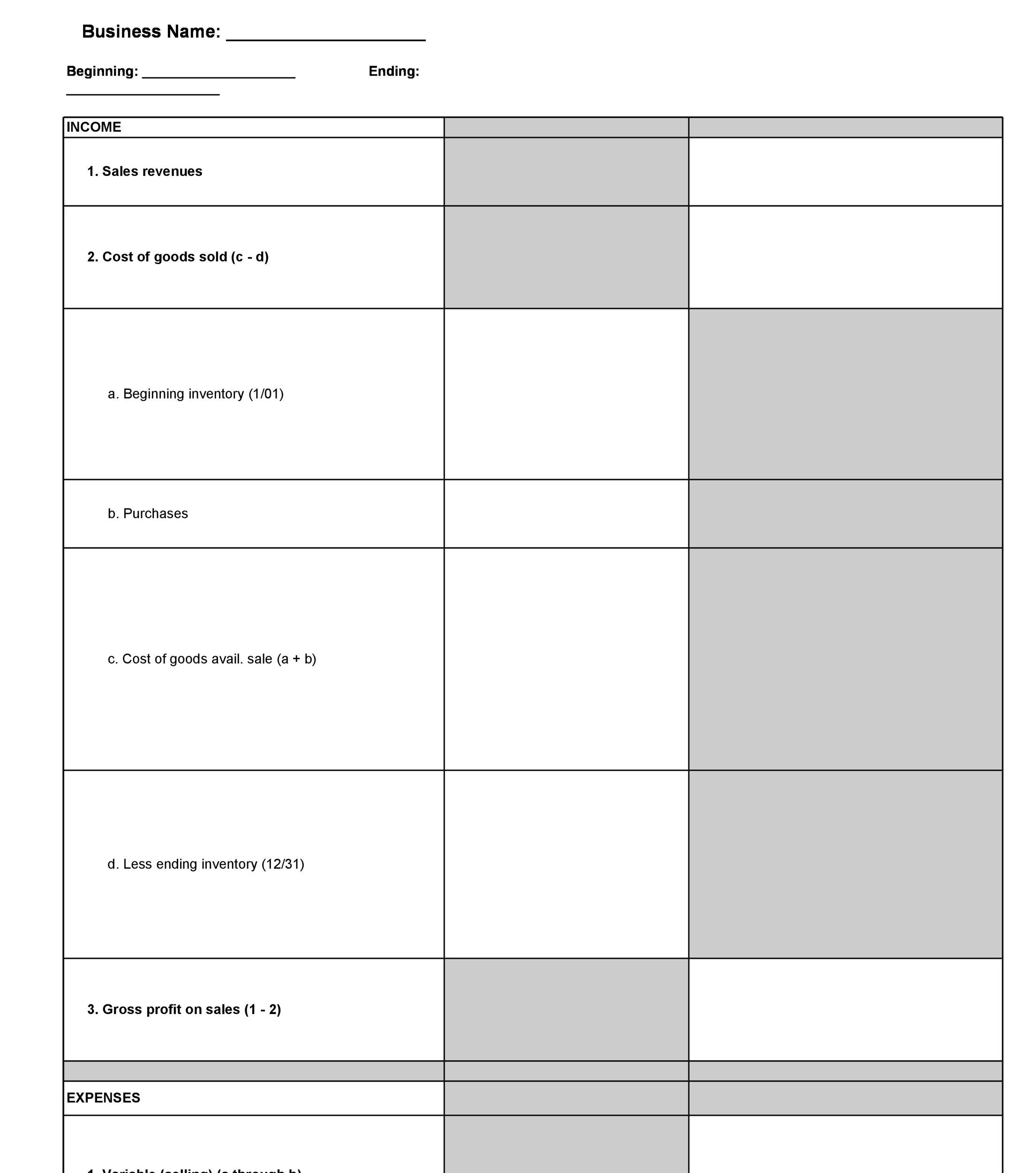

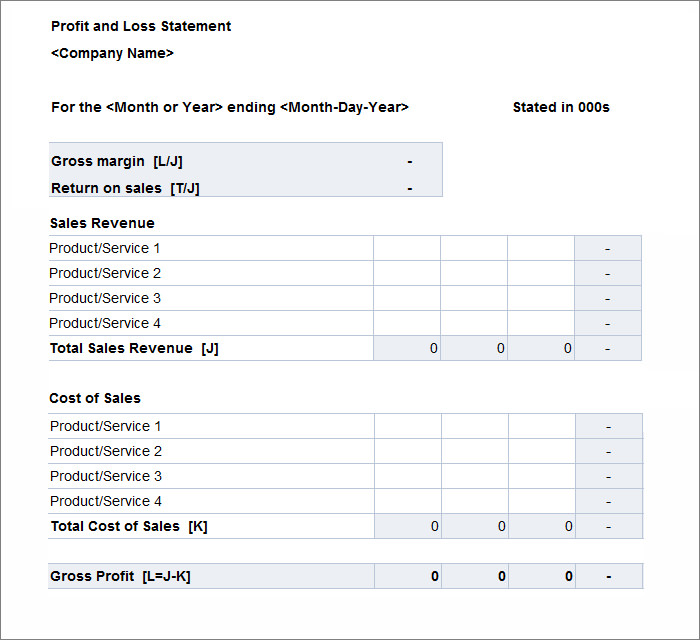

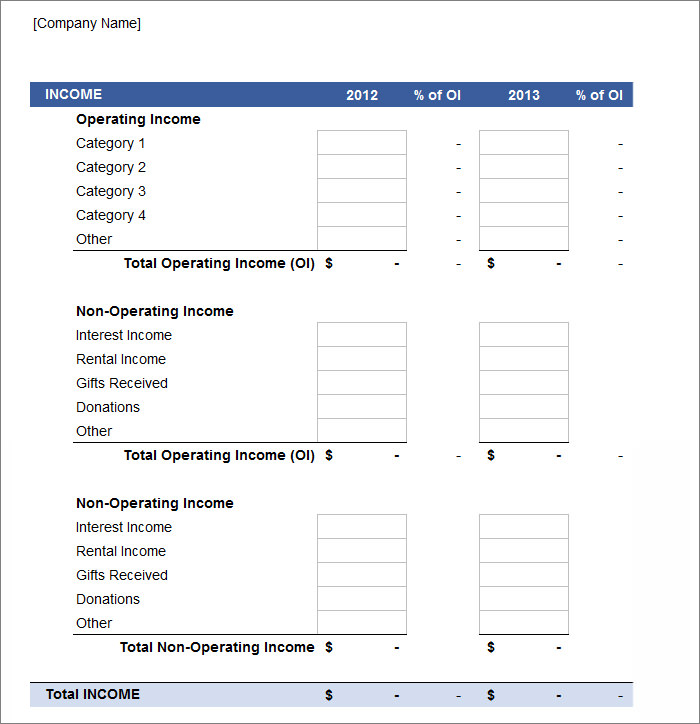

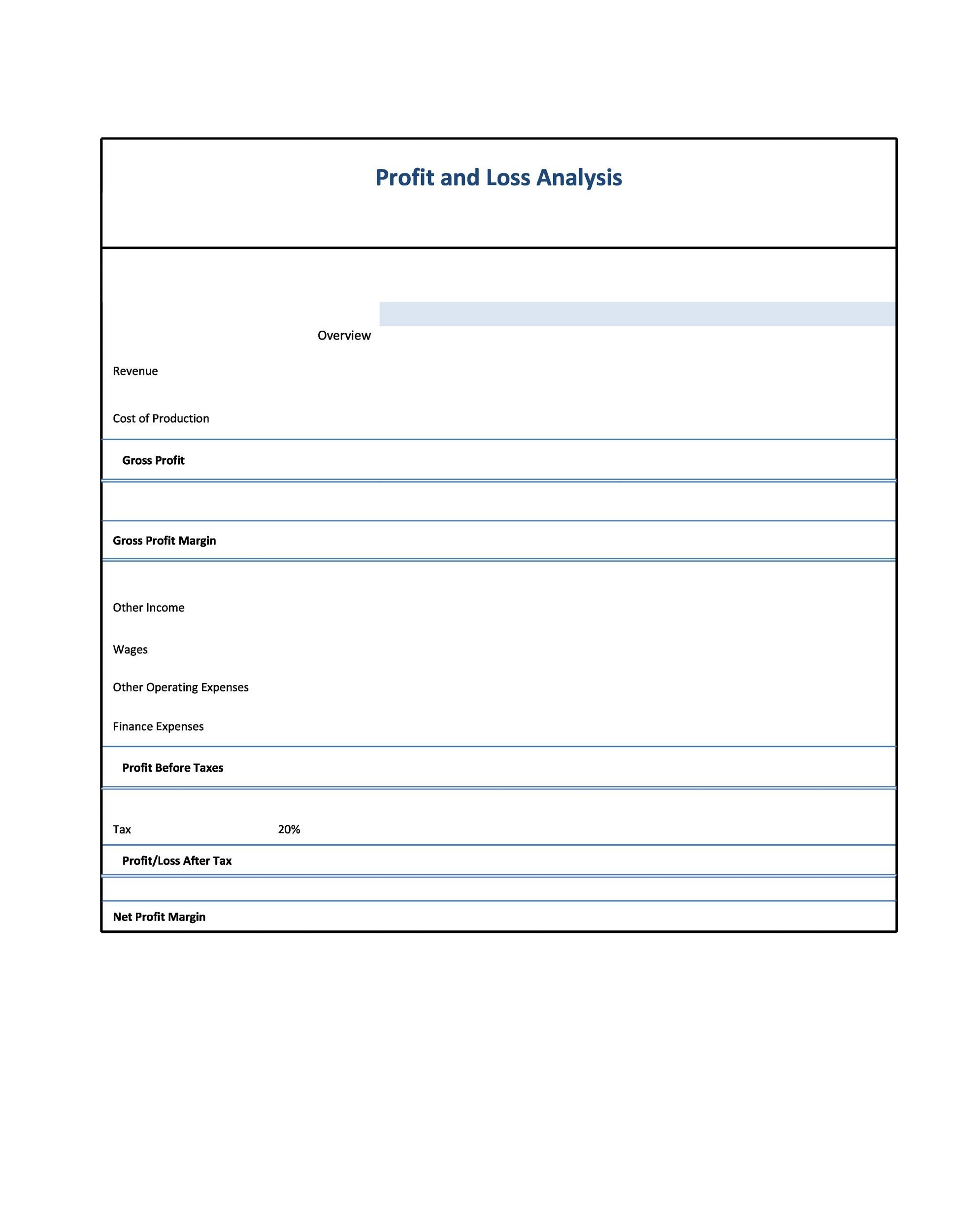

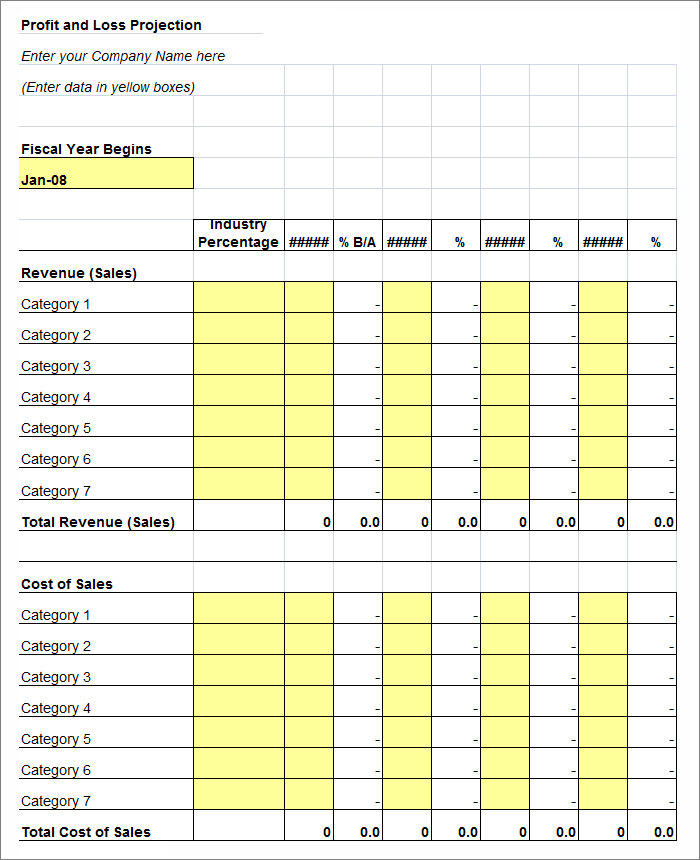

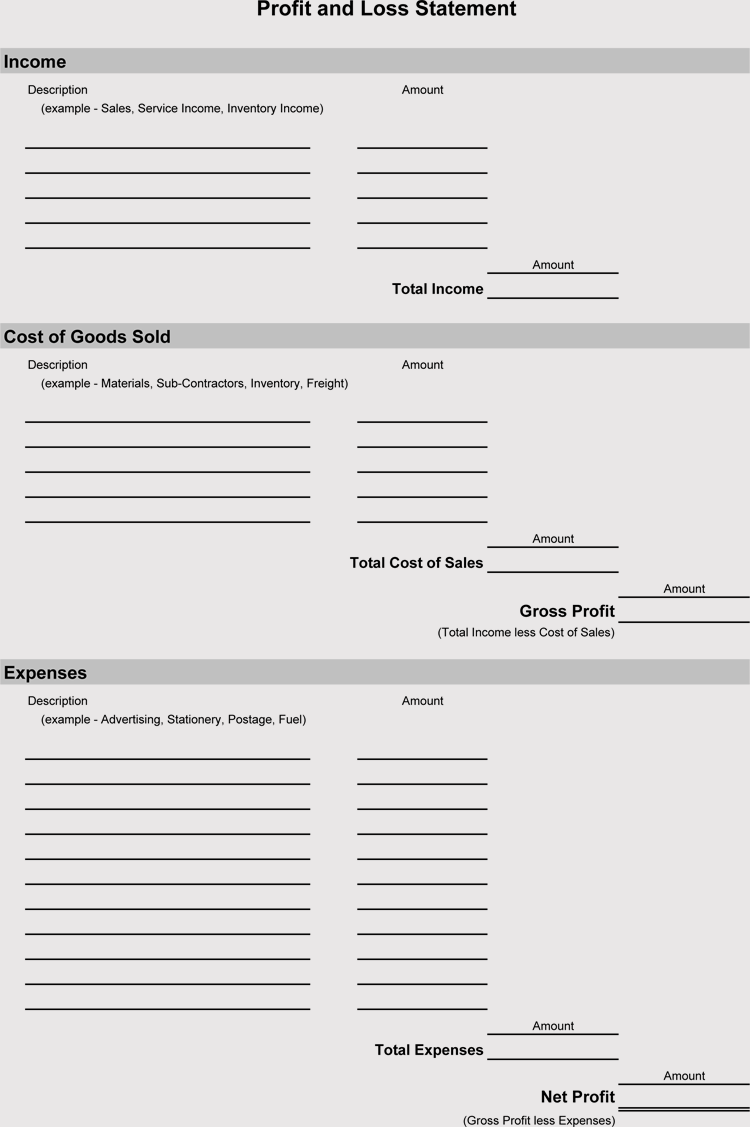

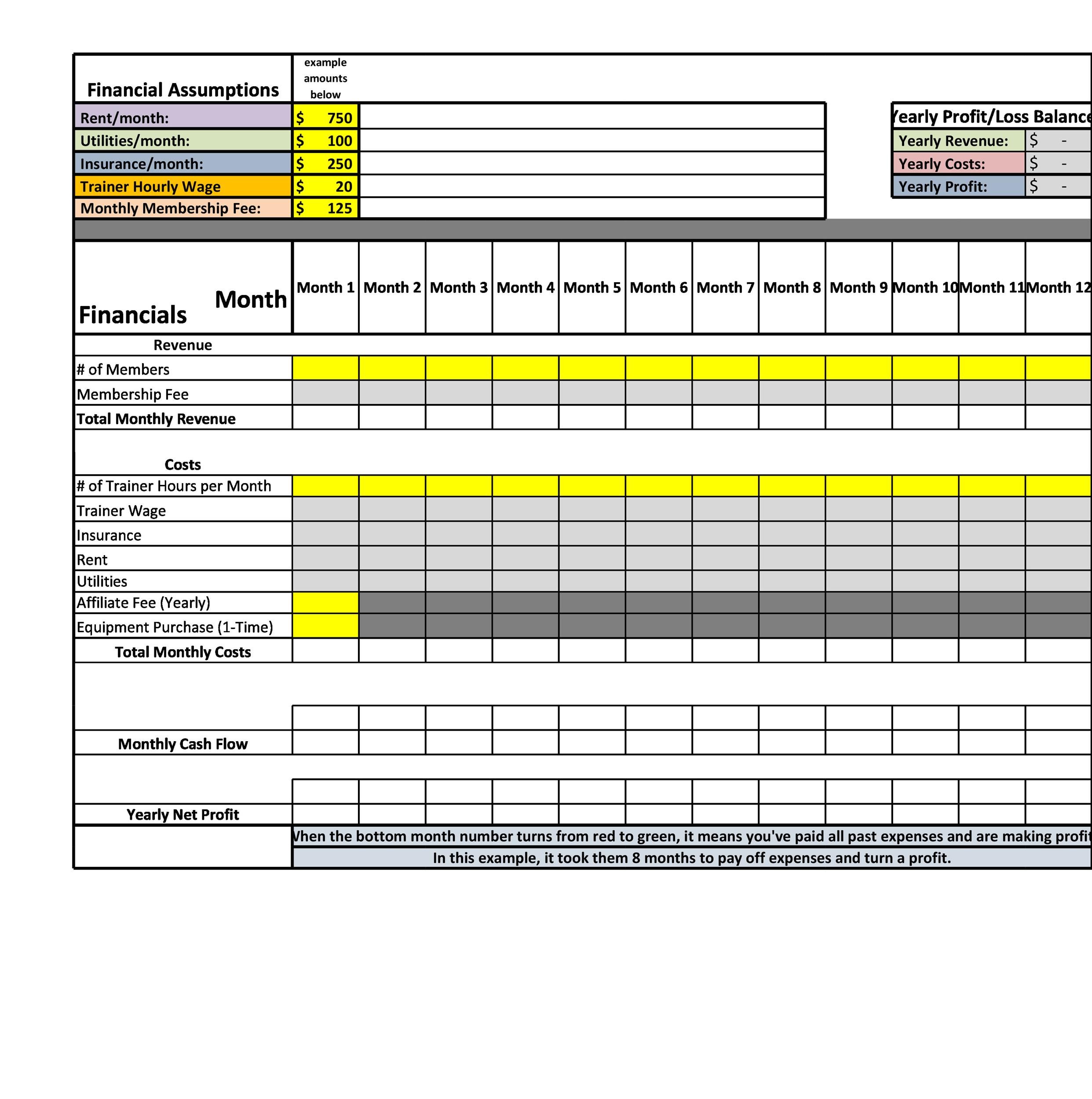

How to make a profit and loss statement template. Use this simple template if the categories under income and expenses dont need to be broken out. The only information you need to fill in is the white cells where data from each quarter should go. An income report contains. Profit and loss statement is one of the fundamental financial statements and lists down overall sales and expenses of the business or company.

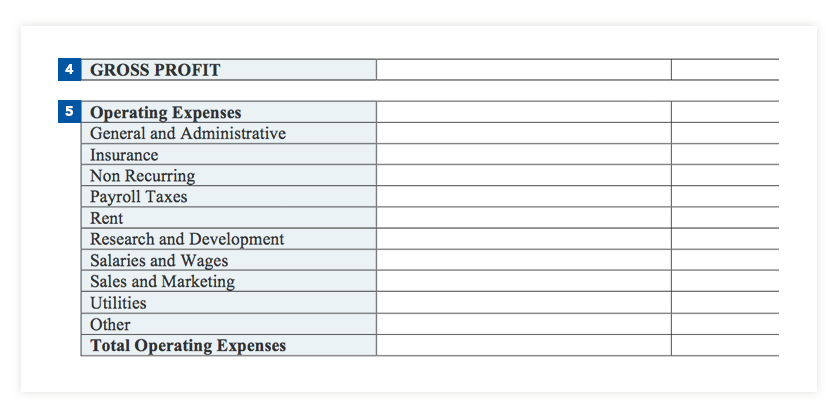

Your biz itemized costsexpenses. Ground breaking i know. Reviewing the profit and loss statement helps the business make decisions and to prepare the business tax return. Profit and loss statement template is a financial document that is used to summarize all revenues expenditures and costs of a business for a specified free word templates printable words templates resumes templates certificate templates rental agreements and legal forms.

This template is ideal for any size business and can easily be changed by adding or removing line items rows as necessary. In order to create a profit loss statement its helpful to know what one tends to contain. There is space on the spreadsheet to enter everything you need in order to create a profit and loss statement. The income section includes space to show income and to deduct the cost of goods sold.

Some accounting programs can also help you put together a profit and loss statement. Profit and loss template is obtainable here for free and can be used to access the financial position of a business company or organization in mentioned period of time. This template can be used by service retail and b2b organizations. Profit and loss templates give you the information you need when you need it for peace of mind and transparency.

For all of you business newbs your p l statement is also known as your income report. The spreadsheet will automatically calculate percentages and totals based on this information. Basic profit and loss template. Formswifts profit and loss statement template is created for business owners who need to easily create the document and do not have access to a program generated option.

Your business tax return will use the information from the pl as the basis for the calculation of net income to determine the income tax your business must pay. A profit and loss statement can be prepared by the owner of the company or the accountant.