Hud Income Calculation Worksheet

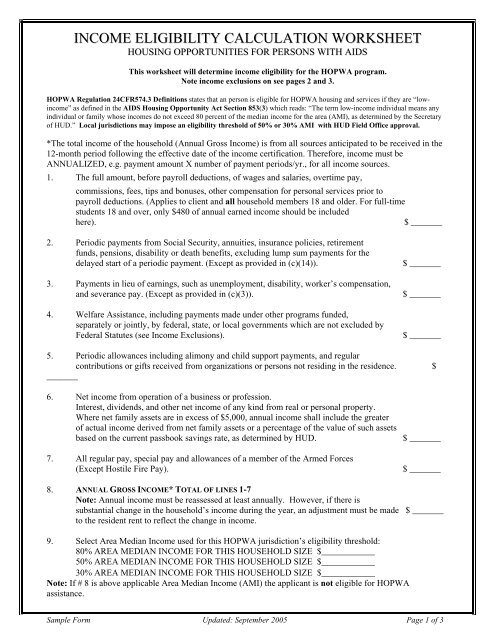

Come eligibility calculation worksheet.

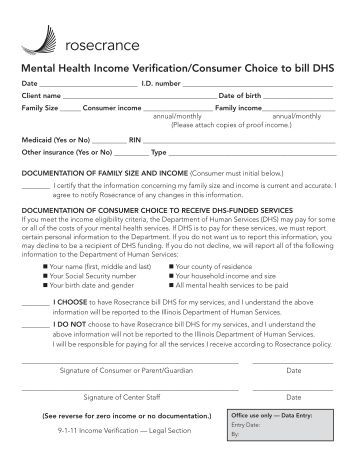

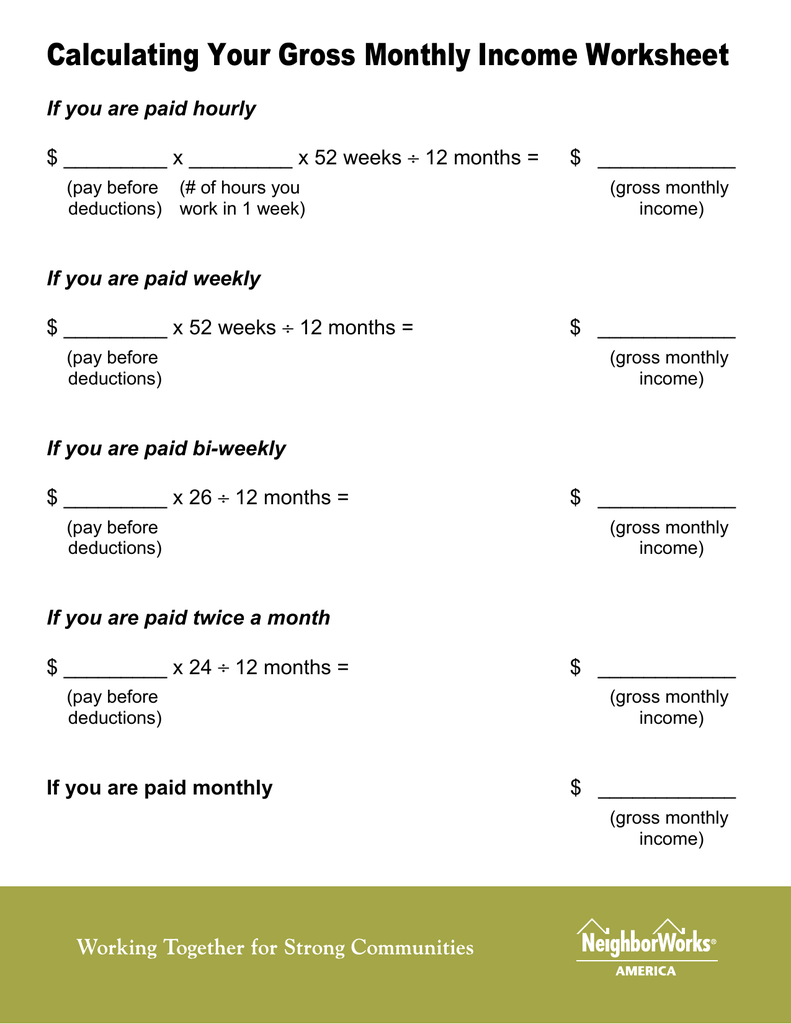

Hud income calculation worksheet. To recalculate the familys income during the summer months at reduced annualized. Hprp income eligibility calculation worksheet. Amount of 7200 600 x 12 months. Documentation of income for all members of the beneficiarys family or household.

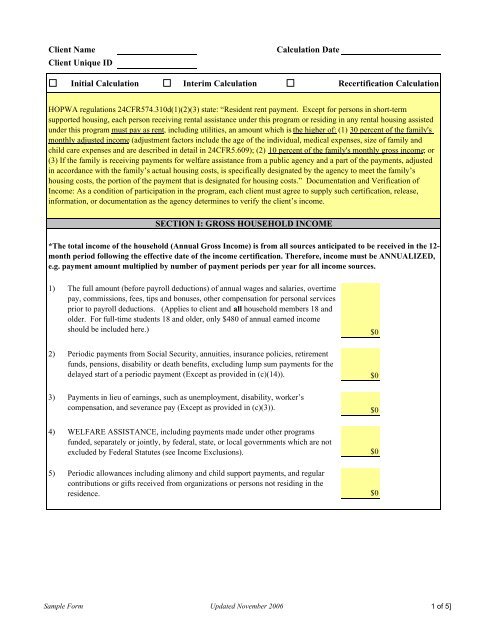

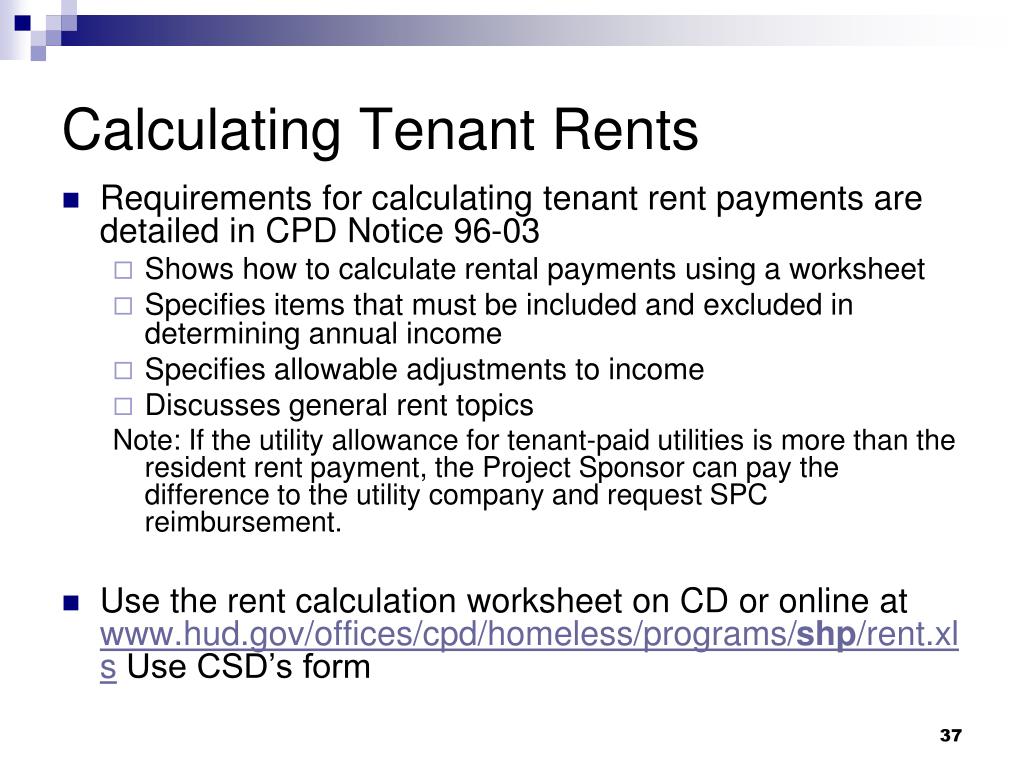

The total income of the household annual gross income is from all sources anticipated to be received in the. Month period following the effective date of the income certification. Payment amount multiplied by number of payment periods per year for all income sources. For income exclusions see cpd notice 96 03.

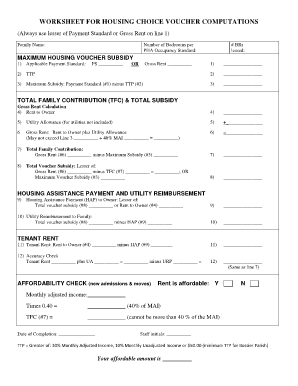

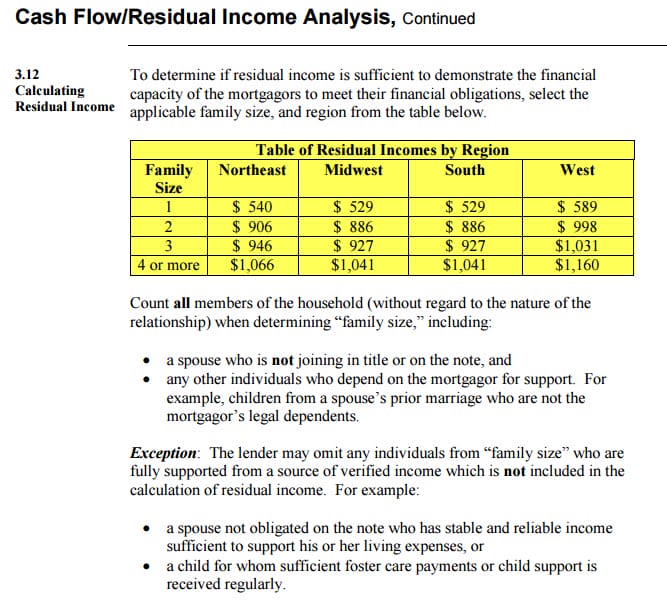

This worksheet will determine the household rent payment based on the greatest of 10 of monthly gross income or 30 of monthly adjusted income. This form provides a format that can be used to assess assets and anticipated income and calculate part 5 annual income in a home program. Sample format for calculating part 5 annual income doc. 15600 1300 x 12 months.

To be eligible for hprp households must be at or below 50 of the area median income and meet other hprp eligibility requirements as outlined in the notice. The total income of the household annual gross income is from all sources anticipated to be received in the 12. This excel workbook was created to assist hopwa grantees and project sponsors determine household income eligibility for all hopwa program activities except housing information services which does not require an income eligibility assessment. Grantees may use this worksheet template to calculate whether an applicant household meets the hprp income eligibility threshold.

Therefore income must be annualized eg. The owner would then conduct an interim recertification at the end of the school year. Hopwa income eligibility worksheet tenant income and rent calculation worksheet.