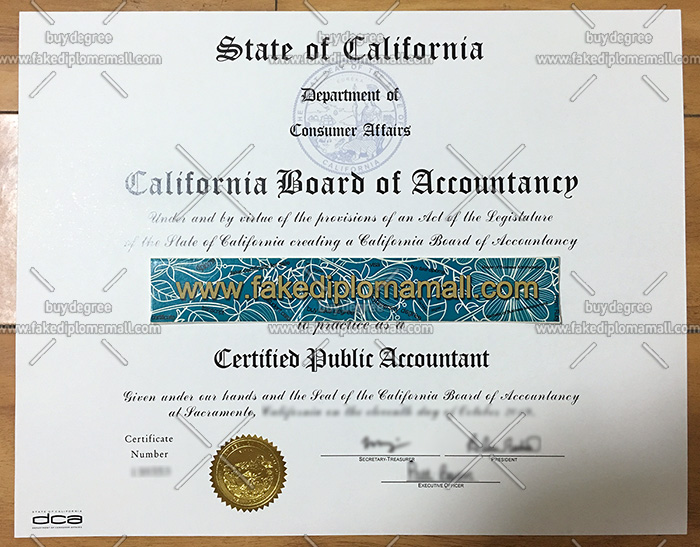

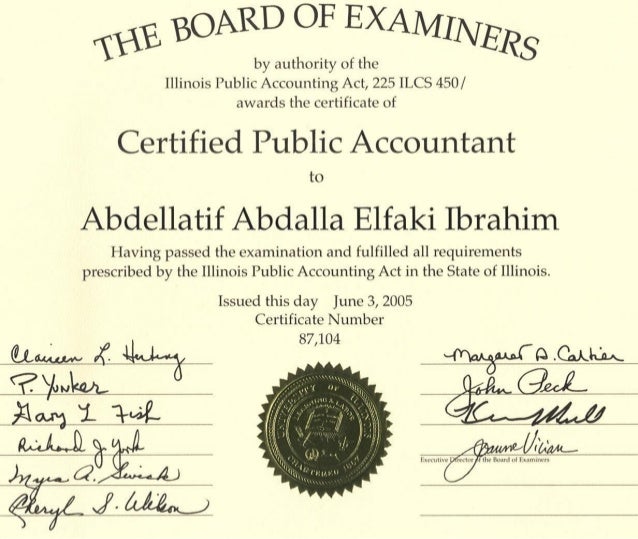

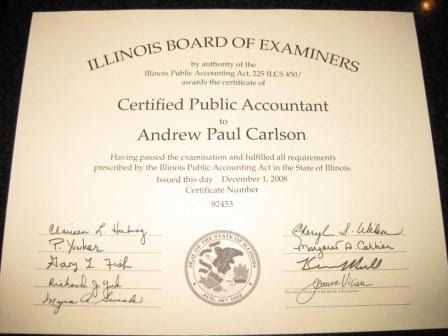

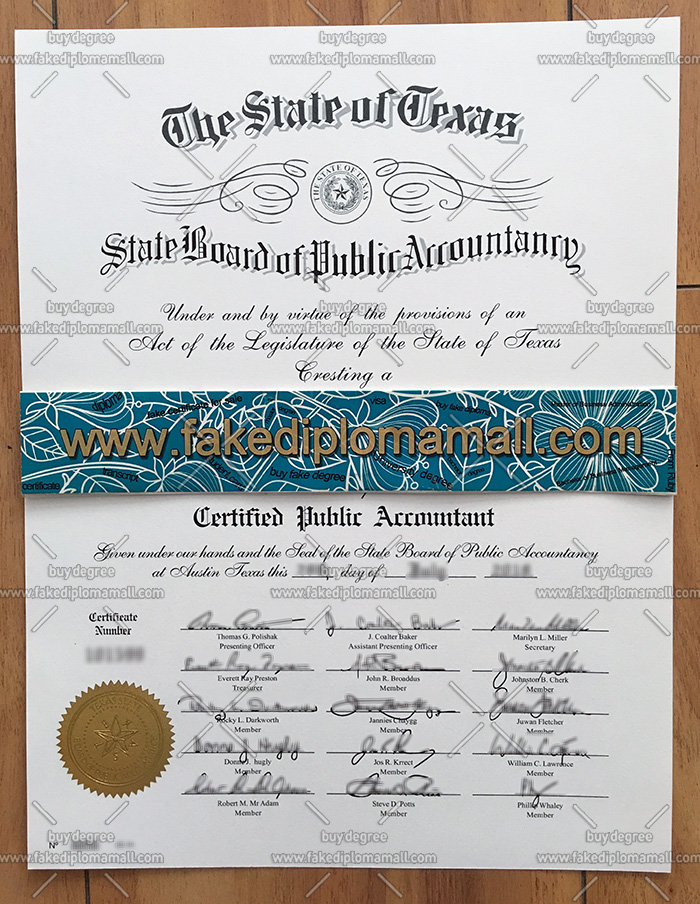

Illinois Cpa Certificate

Thirty semester hours must be in accounting.

Illinois cpa certificate. A candidate has passed all four 4 sections of the uniform cpa exam as well as the aicpa ethics exam. Determine a cpa or cpa firms credentials without having to search each of the 55 boards of accountancy website individually. Once you have passed the uniform cpa exam and the aicpa ethics exam you will receive automatic certification as a cpa from the illinois board of examiners. Change your browser settings to enable cookies for this site and then press continue.

However you are not yet licensed as a cpa. Requirements for the illinois cpa certificate. To sit for the cpa examination in illinois effective july 1 2013 the candidate must have a total of 150 hours of acceptable college level education including at least a bachelors degree. As a result the ilboe has issued a certificate number.

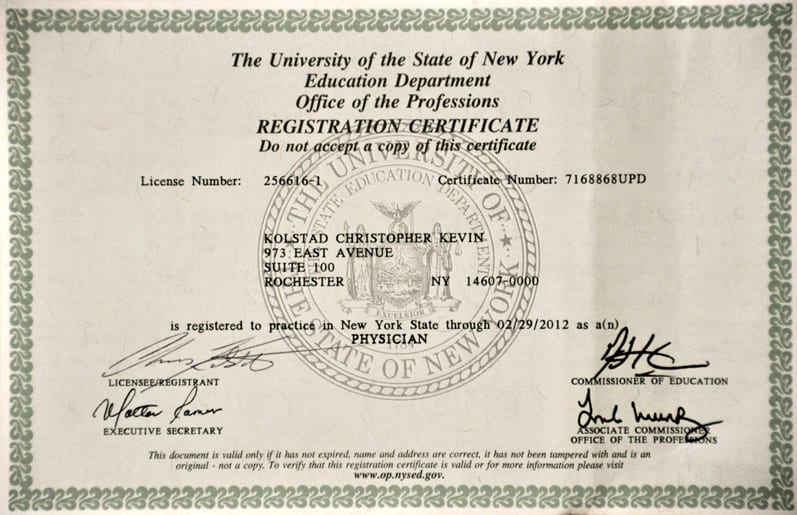

Licensed certified public accountant letter of authorization public accountant continuing education ce public accountant out of state continuing education ce petition for restoration from discipline petition for hearing. Single source national database of licensed cpas and cpa firms. A cpa certificate from the illinois board of examiners shall not authorize the holder to hold themselves out to the public as a certified public accountant in illinois by using the title certified public accountant or the abbreviation cpa or any words or letters to indicate that the person. However the candidate is not yet licensed.

A candidate has passed all four 4 sections of the uniform cpa exam as well as the aicpa ethics exam. Overview in 2006 it became law that in order for anyone to hold themselves out as a cpa to the public in illinois they must have an active license or registration with the illinois department of financial and professional regulation idfpr.