Owner Carry Contract Template

Owner financing is an alternative to a residential mortgage loan with advantages and disadvantages that buyers and sellers should consider carefully.

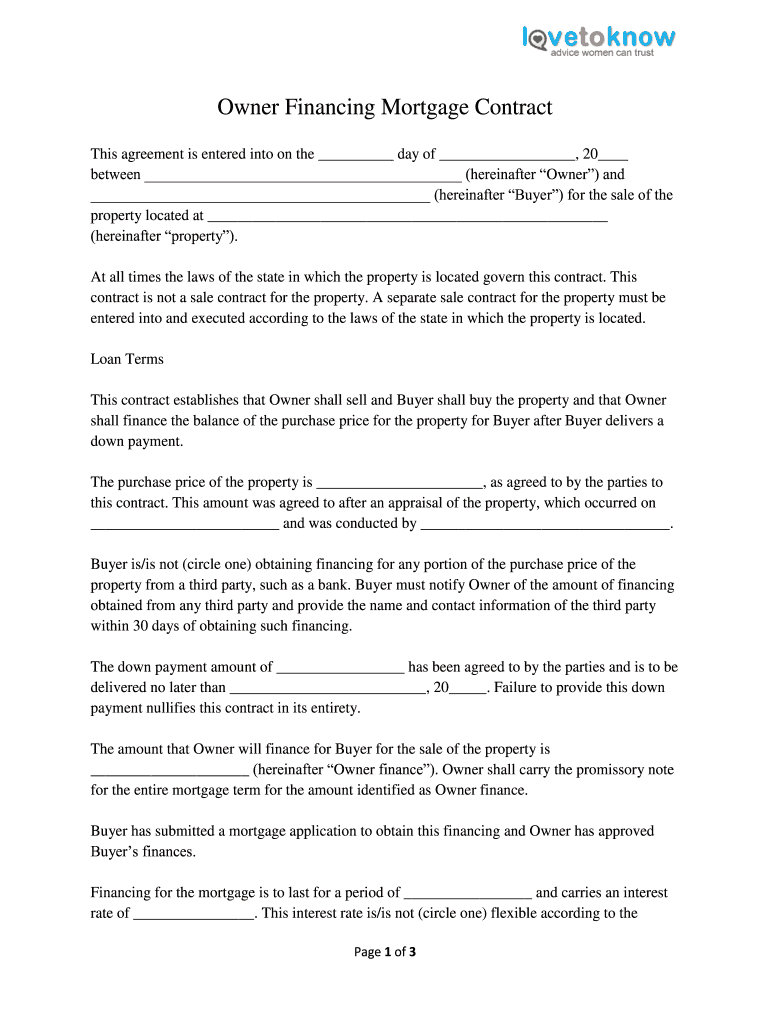

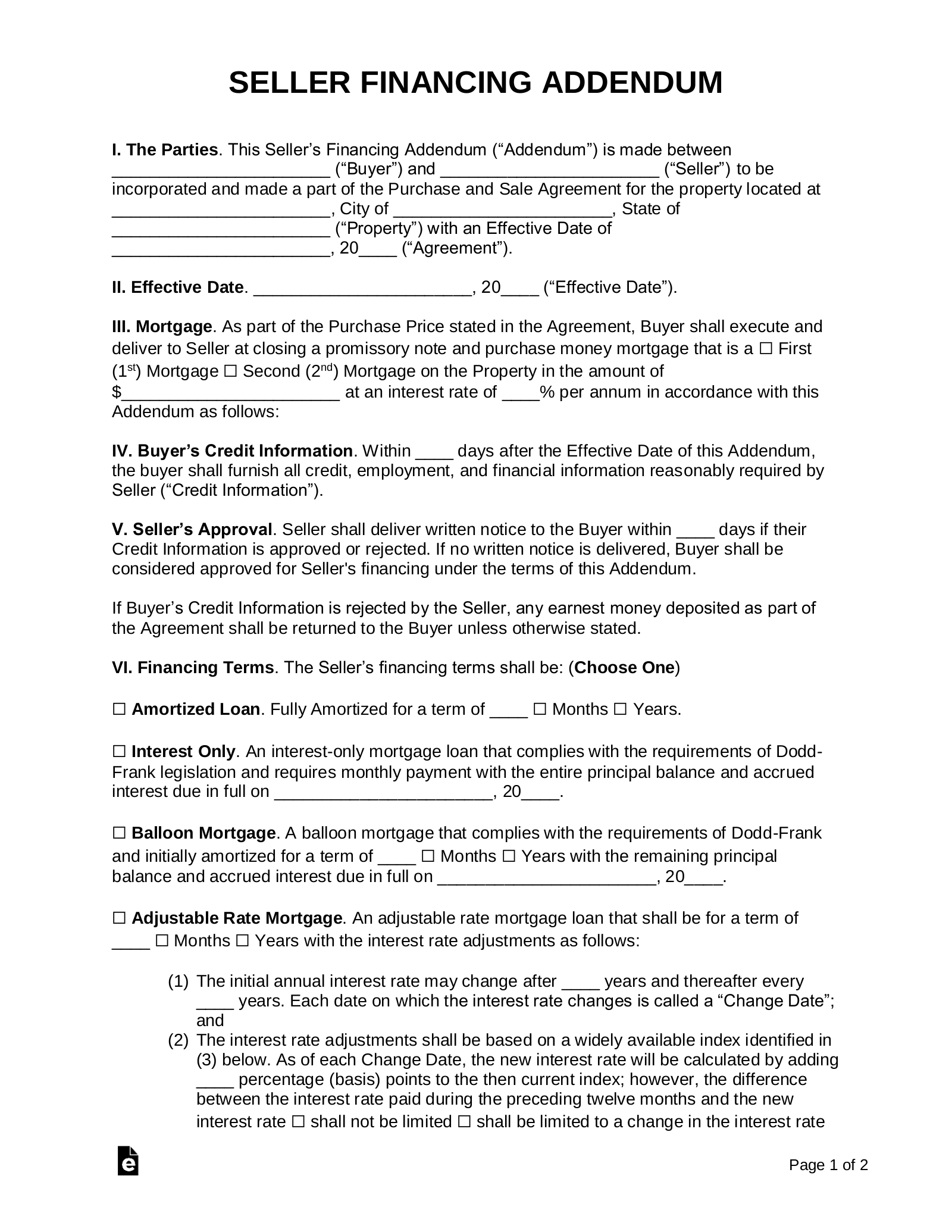

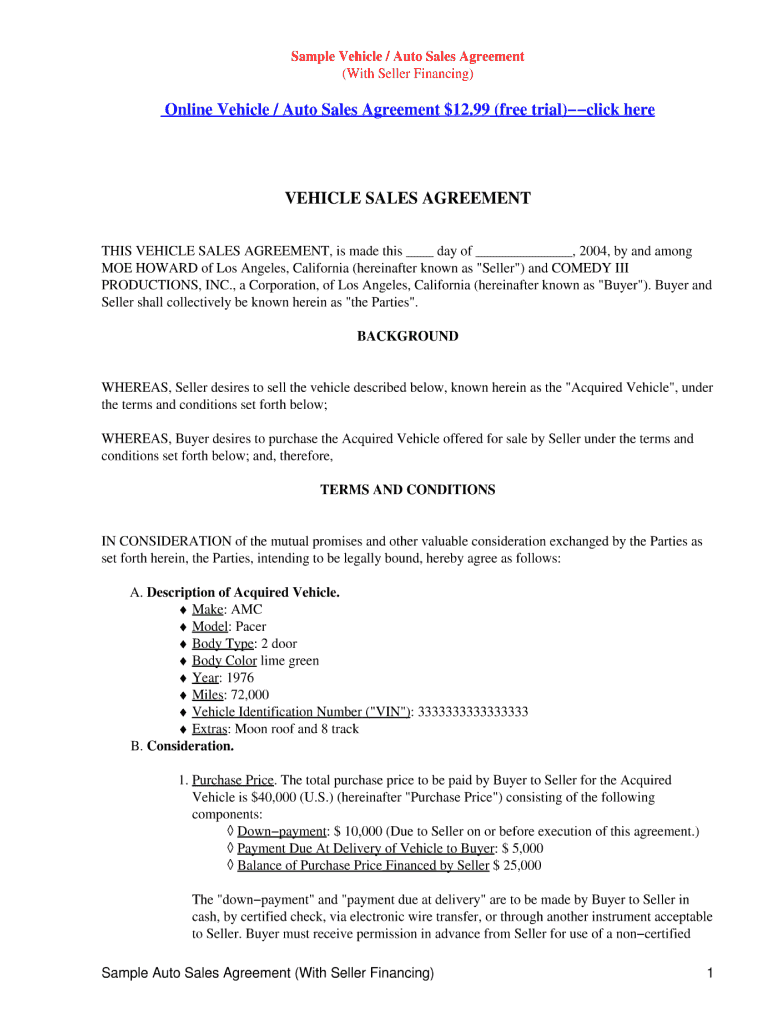

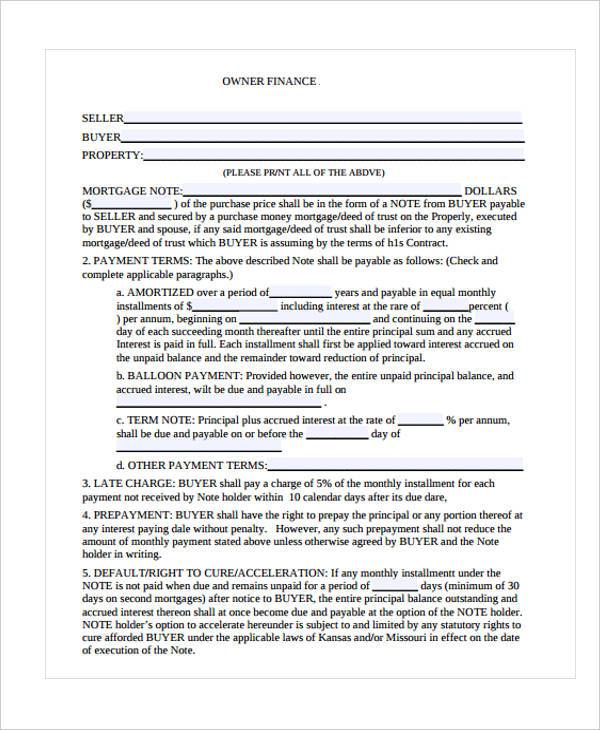

Owner carry contract template. Owner carry mortgage when you carry back a mortgage and you give the buyer the legal title to the property he gets all of the same protections that hed get if he went to a bank and got a loan. Include a statement explaining that the owner is transferring the property to the buyer and when the ownership is being transferred. Offering owner financing is one way to stand out from the sea of inventory attracting a different set of buyers and moving an otherwise hard to sell property. Owner financing is where a person putting up his house for sale offers a part of or the entire purchase price to the purchaser as a loan in order to help the purchaser.

Real estate contracts are agreements between a property owner and buyers looking for a place to live or a place to conduct a business. Payments are usually in the form of monthly installments of principal and interest. Owner carry of a real estate contract is an excellent way for sellers and buyers to come together when standard mortgage options are not available. For example if you enter into a land contract with someone and agree that if they pay 1000 per month for five years the property is theirs youll have to put in a date on which youll deed the property to them upon payment of all obligations.

Seller financing is a way for borrowers to get into a house build equity and improve their credit situation. The term owner carry means the seller is financing the mortgage of his own home. Sometimes borrowers dont fit into the guidelines of a traditional bank loan. When the sales market is slow sellers seek opportunities to lock in a sale.

The purchaser has an immediate right to possession of the property. This contract establishes that owner shall sell and buyer shall buy the property and that owner shall finance the balance of the purchase price for the property for buyer after buyer delivers a down payment. The owner financed loan can carry a higher rate of interest than a seller might receive in a money market account or other low risk types of investments. To get the property back from him youll need to go through a formal foreclosure procedure which may also include a redemption period.